Fundrise Review

After reading the Rich Dad books in the early 2000's we were confident that investing in real estate warranted further research.

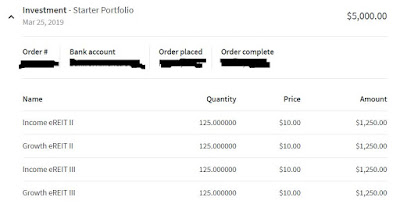

We found Fundrise in early 2019 and spent time researching, learning and reviewing. After a few emails and conversations, we reached the conclusion that it was something worth considering.

The ability to allocate funds to multiple goals provided an additional level of confidence that the investment would be diversified and provide a balance between income and capital growth.

We were willing to allocate a small amount to access and monitor real world performance and would have gladly allocated further funds and referred friends to the platform.

Fundrise experience

The platform, like many in the emerging fintech, proptech and crowdfunding space is a great concept and provides an entry into a market that was not previously accessible to the average investor. The alternatives are to directly own real estate or participate in syndication. In our opinion, the simplest method is to invest in the real estate sector is through an ETF.

As an average or beginner investor the website, tools and information are compelling and informative. There is a a high level of transparency and we clearly understood that this would be a long term investment (~5-10 years). Our perception and interpretation was that investments would provide a low percentage of return initially and would grow over the years from appreciation in the underlying assets. Makes sense - a developer has to plan, obtain permits, build and then sell/rent a property. This could take months or years.

Fees

Fundrise charges a advisory fee for providing access to the platform and funds, same as any brokerage providing access to a mutual fund or ETF. They were also clear from day one, of an early surrender charge, should an investor choose to redeem/cash out early. Think of this as a early termination fee on a bank CD.

In recent years, almost all stock broker platforms have dropped their commissions to zero. Fundrise and the crowdfunding space feels like the early days, think 1990s when you had to call a broker to buy a share and commissions were common and in some cases significantly higher.

Timeline

Subsequent investment

Performance

Returns are calculated and paid out 10-15 days after the quarter end. To date, returns have been on in the low single digits. The challenges of 2020 have also reduced return, as expected. We opted to have the return paid out, instead of reinvested. Payments have been on time and meet expectations.

Tax

Annual tax reporting documents were provided in a timely manner.

Fundrise investments, based on your portfolio selection, invest in properties in multiple states. As designed and selected, right ?

In initial conversations and discussions on the tax consequences, we understood that they would provide a single K1. It turns out that they really meant a single K1 for each individual investment in the portfolio.

What this means is that an investor has to submit additional tax returns for multiple states. The additional tax preparation cost could significantly offset any gains.